Menu

Our Accreditations

Pension Service Bureau and Accountants

What is Pension process?

Pension and auto-enrolment duties were introduced by the Pension Regulatoras part of the UK pension regulations.

It requires employer's to put eligible staff into pension and run a pension scheme for them.

Each employer must pay 5% of the pensionable earnings from employees pay and contribute 3% for their employees.

We are accountants for pensions in Romford and manage payroll process for our clients. It includes providing payslips, submitting RTI data and managing the pensions.

What is a Payroll Process?

Paying staff correct wages and reporting accurate records to HMRC via Real Time Information RTI system is required. There are penalties for non compliance

Payroll Accountant

What are accounts for businesses & Companies

Choose a Price Plan 🏦

Total fee (annual fee) = monthly fee x 12

Total fee is spread over 12 months accounting period

Total fee is payable where historic work is required to be completed

- Regular Reminders

- Annual Accounts

- Tax Returns

- Tax Computations

- Deadline Management

- Monthly Payroll

- VAT Returns

- Regular Reminders

- Annual Accounts

- Tax Returns

- Tax Computations

- Deadline Management

- Monthly Payroll

- VAT Returns

Get 40% off for three months use code 40OFF3

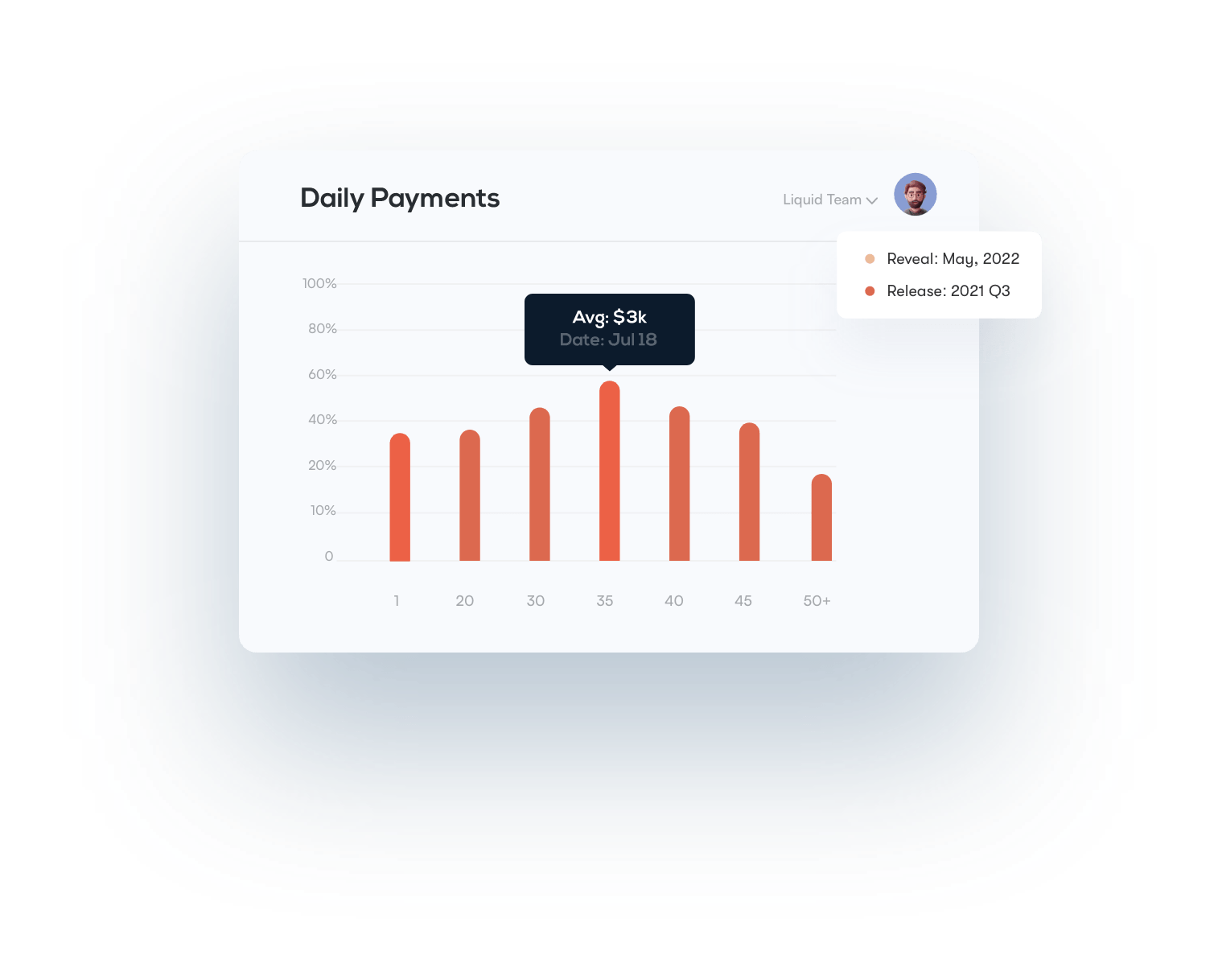

All Accounting tools That you need.

Online softwares to mobile apps.

Choose what suits you and check our price plans to get what suits you best in your monthly budget. your monthly budget.

A very common question is that what should I choose, a Limited Company or a sole trader self-employed business structure? Answer depends on individual circumtances and is best to contact us to evaluate.

OurExpert Staff has years of Experience in advising and managing business and accounting frame work for clients. Do read our reviews to see how establish we are and our clients highly recommend us.

Get in Touch

Call us

Our customer service assistants are here to help. Call us on 0170 862 9024

Contact form

Leave your enquiry by completing our form contact us

Send an Email

Send us an email with your query to get started.

Let's

Begin

Our app lets you login securely and complete your business details to your company in our system.

Free Download Easy to use Takes 60 Seconds